the blow your mind thread

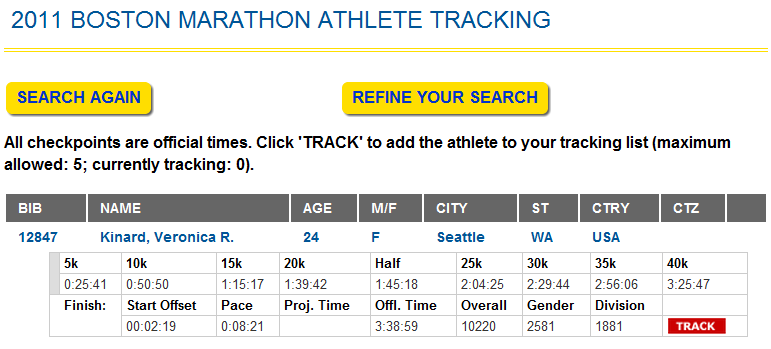

omg v requalified for the boston marathon at the boston marathon. woohoo!

imma go ahead and say it running that fast for that long is ridiculous good job v

I've always had the vague notion that the idea I summarize as "your stock price can drop because you only made $3.6B in profit instead of $3.68B like you said you would" (and apparently is more succinctly referred to as "the expectations market" by people who know better) is total bullshit. Here's an article (about a book) that articulates why it's bullshit.

"Maximizing shareholder value" is the correct answer for the primary goal of a company in my MBA level finance exam. But also in the curriculum global business and organization behavior state an effective manager should be concerned with shareholders external/internal direct/indirect. However in the short term it's much easier to create market value than real value. It's an email to accounting vs. building a factory. Plus capital gains tax is 15% (as long as you hold the asset over one year) vs. 35% corporate income tax. And more and more people are becoming corporate shareholders through IRAs and privately managed pension funds. An emphasis on real value would be better for long term solvency but few working people would be willing to take even more hits to their retirement even if the alternative is likely to yield better returns in the long term.

Ideally the market should fix these problems. Anyone seeking a long term investment should be wary of firms with executive compensation tied to stock price. But those wishing to make a quick buck should be rewarded for assuming a higher risk premium. The CEO may or may not be cooking the books. If they aren't hey 20% returns sweet if they are whoops I lost all my money. Because unless you're a congressperson on a long enough timeline you're not going to beat the market rate.

So how do you emphasize real value over market value? I'm all for reducing or maybe eliminating corporate income tax. The cost only passed on to the consumer anyways. If you want to emphasize real over market that's the way to go because raising the capital gains tax pretty much has negative effects other than the warm fuzzy feeling you get when 1%ers paying their fair share. I don't think I can get on board with forbidding or regulating executive compensation. You should be free to pay or get paid whatever you want. Investors just need to be smarter but there's no way to regulate that. Fraud needs to be more heavily enforced and prosecuted. Deterrence ftw.

reminds me of Space Invaders